Years ago, dream vacations were upshots of years of hard work, tightening of belts and retirement benefits. Vacationists were either retired individuals, on-the-spot millionaires or those born with a golden spoon in their mouth. Dream holidays were exactly that; dreams particularly for a common man. That scenario has evolved now, as this time, your travel card as the best choices are a couple of clicks away. Today's technology opens the door to a very gigantic global market any traveler and regular earning family can get the superlative deals from to travel places and live the dream vacation they have always desired. And the best travel discounts are a vacationist's reward, thanks to international travel card privileges.

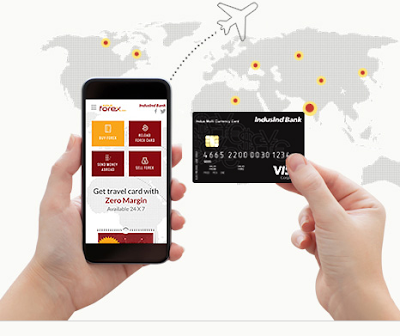

Having travel privilege cards is like having the key to every chief city and travel spot all across the world. For sure, the travel discount rain on all corners when you have this card. Prepaid travel cards, also acknowledged as currency cards, permit you to load them before you go abroad then just use them as you would a debit card to spend or withdraw cash. And since they are pre-loaded, it permits you to keep tight control of your spending. Prepaid cards are used for making payments while you are roaming in a foreign country. They enable you to access money in the required provincial currency. You can also top it up reliant on your requisite.

The international travel card permits you to withdraw cash in foreign currency, check your balance and shop around. This card is very cheap all through the nation. When you contemplate the safety and easy conversion facility, you will assuredly appreciate the benefits of prepaid travel card. There are countless other advantages of a prepaid Forex card for international tourists such as Forex cards being cheaper than the debit or credit cards. Furthermore, they are accepted extensively throughout a foreign realm. Now that you have got access to all the finest choices to realize your dream vacation, don't just go to one website and then book your schedule.

Best to have the worthy offers printed and equal the rates. Remember the first rule on asking, because if there is a way to combine the best of all offers, then you have got a platter of all best travel discounts served just for you and the travel group! What every explorer and adventure addict needs is a travel card. Go ahead, travel and live your dream!

To Know More :

https://onlineforexcard.wordpress.com/2018/03/14/comprehensive-guide-of-forex-travel-card-and-its-benefits/

Having travel privilege cards is like having the key to every chief city and travel spot all across the world. For sure, the travel discount rain on all corners when you have this card. Prepaid travel cards, also acknowledged as currency cards, permit you to load them before you go abroad then just use them as you would a debit card to spend or withdraw cash. And since they are pre-loaded, it permits you to keep tight control of your spending. Prepaid cards are used for making payments while you are roaming in a foreign country. They enable you to access money in the required provincial currency. You can also top it up reliant on your requisite.

The international travel card permits you to withdraw cash in foreign currency, check your balance and shop around. This card is very cheap all through the nation. When you contemplate the safety and easy conversion facility, you will assuredly appreciate the benefits of prepaid travel card. There are countless other advantages of a prepaid Forex card for international tourists such as Forex cards being cheaper than the debit or credit cards. Furthermore, they are accepted extensively throughout a foreign realm. Now that you have got access to all the finest choices to realize your dream vacation, don't just go to one website and then book your schedule.

Best to have the worthy offers printed and equal the rates. Remember the first rule on asking, because if there is a way to combine the best of all offers, then you have got a platter of all best travel discounts served just for you and the travel group! What every explorer and adventure addict needs is a travel card. Go ahead, travel and live your dream!

To Know More :

https://onlineforexcard.wordpress.com/2018/03/14/comprehensive-guide-of-forex-travel-card-and-its-benefits/